Are you short of funds and planning to borrow from the best licensed moneylender in Singapore? But before that, you must first understand the things to consider before borrowing from the best licensed moneylenders in Singapore or credit companies.

Paying off bills and expenses without any assistance can be really challenging, especially when you’re living in one of the most expensive cities in the world — Singapore. Things like medical bills and wedding costs, for instance, can easily cost thousands of dollars in Singapore.

When there’s not enough money to pay off these expenses, most people may choose to take out loans from the bank. But banks tend to have a longer and more stringent approval process, which might not be helpful if you need cash urgently.

This is why when it comes to loans, licensed moneylenders are a viable alternative to banks since they generally have faster approval. But borrowing from them or with 24-hour licensed money lenders in Singapore may not be something that sits well with everyone.

“Is borrowing from a licensed moneylender really safe?” is one of the concerns that people have when it comes to borrowing from them.

Well, contrary to popular belief, all licensed moneylenders are governed by the Ministry of Law (MinLaw). They’re very much different from illegal moneylenders, so it’s really safe to borrow from them.

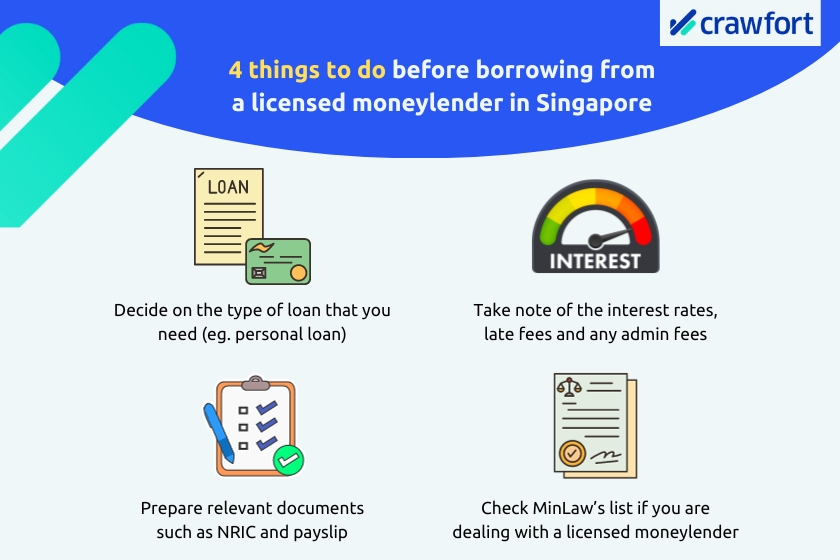

Before you start borrowing from the Singapore’s best moneylender, here are some things to consider.

What Do You Need To Do Before Borrowing From A Licensed Moneylender In Singapore?

Be sure to check if the moneylender you’re dealing with is a licensed one

Decide On The Type Of Loan That You Need from a Licensed Moneylender

Before applying for a personal loan, from the best moneylender in Singapore, be sure to evaluate your finances to decide on the type of loan to take out. Ask yourself this question: Are you dealing with a small emergency or a major one?

In the case of minor crises that require only a small sum of money, personal loans are an ideal choice. In addition, they are suitable for paying off home renovation, credit card debts, or consolidating your debts.

Research On The Loan You’re Planning To Take From A Licensed Moneylender

Once you’ve decided on the type of loan to take, do some research on its repayment terms.

Get Your Credit Report

You may also consider buying a credit report from either the Credit Bureau Singapore (CBS) or the Moneylenders Credit Bureau (MLCB) to get an idea of your credit rating.

Though many licensed moneylenders in Singapore do not check a borrower’s credit report, especially in the case of personal loans, some moneylenders do not approve loans to borrowers with a bad credit rating.

If you have a bad credit rating, it’s better to clean it up a bit before making a loan application.

Got a bad credit score? Find out how you can still get a personal loan here.

Read: How to Improve Credit Score in Singapore

Check Your Eligibility

Be sure to also check if you’re eligible for the type of loan you’re taking. Keep in mind that in Singapore, the maximum loan amount you’re eligible for depends on your annual income.

Here’s a table illustrating the maximum loan amount you can borrow from licensed moneylenders in Singapore based on your income and citizenship.

| Annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

| Less than S$10,000 | S$3,000 | S$500 |

| At least S$10,000 and less than S$20,000 | S$3,000 | S$3,000 |

| At least S$20,000 | 6 times of monthly income | 6 times of monthly income |

Prepare All The Documents That You’ll Need Before Going To A Licensed Moneylender Office

Once you’re clear on the finer details, start collecting all the documents you’ll need to apply for the loan. These include:

- Proof of income and employment

- NRIC

- Current credit score and past CPF statements

- Residency proof

- Tenancy agreement, employment letter, employment pass, and bank statements (for foreigners)

When it comes to approving unsecured loans such as personal loans, licensed moneylenders usually approve them based on annual income and not your credit history. This is why they usually ask for payslips to evaluate your financial ability to pay back the loan.

Is There A Cap On The Costs Involved When Borrowing From A Licensed Moneylender?

All licensed moneylenders in Singapore are required to adhere to the rules set by MinLaw. There’s a limit on interest, late fees, and other costs that they can charge borrowers.

As of 1st October 2015, licensed moneylenders can only impose the following:

- The interest rate of not more than 4% per month

- The late interest of not more than 4% per month

- A late fee of not more than S$60 per month

- An administrative fee that must not exceed 10% of the principal loan granted

- Legal costs ordered by the court for the licensed moneylender to recover the loan amount

In general, the total cost charged by a legal lender, including interest, late interest, administrative fees, late fees, and other related charges, must not exceed the principal loan amount.

How To Check If I’m Dealing With A Licensed Moneylender Or A Loan Scam?

One important thing to learn before borrowing from a moneylender is differentiating between licensed moneylenders from the unauthorised ones.

And, here’s how to check a licensed moneylender.

Check If The Licensed Moneylender Is On Minlaw’s Registry

The easiest way to check if a moneylender is licensed or not is to refer to the list of licensed moneylenders in Singapore. Each month the Registry of Moneylenders provides an updated licensed moneylender. So, you can avoid blacklisted moneylenders in Singapore when taking a personal loan.

Besides checking if their license is still valid, you should take some time to read through the licensed moneylender reviews.

Take Note Of The Licensed Moneylender’s Advertisements

If a moneylender is offering you loans through phone calls or text messages, you’re probably dealing with an unlicensed moneylender in Singapore (often called “Ah Long” in Singapore) or a licensed moneylender violating the rules.

According to MinLaw’s website, licensed moneylenders can only advertise through the following channels:

- Business or consumer directories

- Websites belonging to the licensed moneylender

- Advertisements placed within licensed moneylender’s the interior and exterior side (such as the wall, door, shutter, gate, and window) of their place of business

In terms of the licensed money lender advertisements, you are advised to seek clarification from them and not to solely rely upon the advertisements. You need to understand fully the terms of the loan contract before borrowing from a licensed moneylender in Singapore.

Check The Licensed Moneylender In Singapore Interest Rates And Fees Offered

As mentioned above, a licensed moneylender follows the standard interest rates and fees imposed by the Registry of Moneylenders.

It is a red flag if you have found the following:

- Monthly Interest rates are higher than 4%

- Late interest rate above 4% for each late repayment

- The late fee is more than S$60

- Administrative is above 10% of the personal loan granted

- Not explaining the interest rates and fees

Above are the major signs that you are dealing with a loan shark. If this is the case, you need to cut off your communication with them. A licensed moneylender in Singapore provides the lowest interest rate than the illegal ones.

Check If The Licensed Moneylender Has A Physical Address

As mentioned the Registry of Moneylender provides a monthly updated list. You will notice that it is a licensed moneylender if it has a physical business address. This is where you will go for the verification process.

Thus, if you are approved for a personal loan without going to a physical address of a moneylender, you are maybe dealing with a loan shark.

Also, if you are provided with a loan and will meet up in an unknown place – this is also a red flag. Make sure that you have checked the official list of licensed moneylenders.

Requires A Face-To-Face Verification With A Licensed Moneylender

Nowadays, it’s common that moneylenders provide an online application due to advances in technology. But, it is still a major requirement to go down to the office of a licensed moneylender for a face-to-face verification.

A face-to-face verification is required before a licensed moneylender proceeds to loan disbursement. If you are receiving just an email or a text message from a lender saying that your loan was approved, it’s time to go away from them.

You need to be careful from dealing with unsolicited calls saying that they can grant you a personal loan. Licensed moneylenders in Singapore are not allowed to send unsolicited emails, text messages, and calls.

Also, if you met a moneylender not providing you clear details about the loan contract or there’s no loan contract at all, it’s time to go away from them.

Always remember that it is a red flag when you are not required for a face-to-face verification within a physical office of a licensed moneylender. It is a major sign that you need to get away from them.

Ensure That You’re Issued With The Relevant Documents

Licensed moneylenders will always return your NRIC and other personal identification documents after evaluating them. They’ll also issue you with a loan contract.

And before you sign the loan contract, they’ll also make it a point to explain to you each term mentioned in it. The loan contract should also include all the relevant details, including interest rate, repayment terms, and the repayment period.

What Do You Need To Note When Dealing With A Licensed Moneylender?

When borrowing from a legal lender, be mindful of the following:

- Using abusive language or behaving in a threatening manner

- Asking you with your Singpasss ID/password

- Retaining your NRIC card or any of your personal ID documents such as your passport, driver licence, work permit, employment pass, or ATM card

- Ask for your signature in a blank or incomplete Note of Contract

- Not giving you a copy of your Note of Contract for the loan after granting you the loan

- Not properly explaining the terms and conditions of the loan

- Granting the loan without following the standard process e.g. approving the loan over the phone or SMS

- Withholding any part of the principal loan without any reason or explanation

Take in mind those practices are not acceptable. If you have encountered them, you must report the licensed moneylender to the registry of Moneylenders providing the moneylender’s business name, licence, and contact number.

You can lodge a complaint against the licensed moneylender Singapore that is involved in unfair practices such as those mentioned above to the Registry of Moneylender. You can contact them at 1800-2255-529. The registry will investigate this matter.

Also, in line with unfair practices, you can pursue this matter through Small Claims Tribunal or the Court under the Consumer Protection (Fair Trading) Act.

Ready to borrow from a licensed moneylender in Singapore? Get started with Crawfort.

What Should You Do Once Your Loan Has Been Approved?

Once your moneylender has approved your loan and has given the principal amount to you, make sure they’ve charged you the correct amount for the approval fee. As noted earlier, a legal moneylender in Singapore can only charge up to 10% of the principal amount for administrative fees.

Documents To Keep

You should also have the following documents for your reference:

- A copy of the loan contract

- Receipts for every payment you’ve made towards your loan

- A statement of account for all your loans

- Copies of all accounts, receipts, and any other relevant document

Pay Your Repayments On Time

Ensure that you’re paying each instalment by the due date.

Paying them late will not only lead to your instalments accumulating but also incurring late fees and late interest. You need to pay a late interest of not more than 4%. Having your debt accumulate can also make it harder to pay it off. Thus, in the end, it can be a problem.

What Are Your Legal Options In Case You Find Yourself Unable To Pay Back The Loan?

When borrowers default on their payments and are unable to pay moneylender in Singapore, licensed moneylenders usually hire debt collection agencies to collect debts.

While there are no laws that regulate debt collection in Singapore, licensed moneylenders and debt collectors are encouraged to abide by the code of ethics laid down by the Credit Collection Association of Singapore.

Debt collectors are not allowed to use violence, harassment, or intimidation as a means to collect debts. In the unfortunate event that you find yourself facing such a situation, be sure to report them to the police.

Learn more about what licensed moneylenders can’t do when collecting debts here.

Request For Extension

The best way to deal with the situation is to talk to your licensed moneylender and negotiate for an extension. You may also consider going to social services to seek help in credit counselling and debt management.

Learn more about how credit counselling and debt management work.

File For Bankruptcy

However, if your debt amounts to at least S$15,000 and you find yourself unable to pay it off even after you’ve restructured your loan repayments, you may consider filing for bankruptcy.

When a borrower files for bankruptcy, the accumulation of interest is stopped. It also prevents moneylenders from carrying out any legal proceedings against the borrower.

Find what happens if you file for bankruptcy here.

Have questions about getting a personal loan? Read our FAQs to find out more.

Some Organisations That You Can Approach For Help

If you find yourself in huge debt, filing for bankruptcy should only be your last resort. You should consider approaching any of these organisations for help.

Credit Counselling Singapore(CCS)

Registry Of Moneylenders (MinLaw)

Credit Collection Association Of Singapore (CCAS)

National Council On Problem Gambling (NCPG)

If you take out a loan or find yourself unable to pay off your loan due to gambling addiction, you should get in touch with the NCPG. The organisation helps gamblers and their families manage problem gambling.

Credit Association Of Singapore

ComCare (MSF)

The Final Word

At the end of the day, there might be times when you find yourself strapped for cash. And one good way of dealing with it is to take a short-term loan and pay it back on time.

While most people will turn to banks to get loans, there are some who turn to private money lenders in Singapore for faster approval. Unfortunately, it’s also uncommon that borrowers run into unauthorised money lenders, who charge very high-interest rates or even scam them.

To safeguard yourself against these illegal money lenders, be sure to engage with only licensed money lenders. If you encounter any unauthorised money lenders, you should report them to the police.